Ace Info About How To Apply For An Efin

Setelah itu, isi kolom subject email dengan kalimat permintaan nomor efin di.

How to apply for an efin. By mark castro, cpa. The correct way to request efin information. Given all the legal jargon and.

Applying for your efin & ptin. Tax preparation involves two essential terms: How to submit an efin renewal.

Page last reviewed or updated: Get your efin or electronic filing identification number and start your tax preparation business. In this video, we will walk you through how to apply for an.

This video gives you a guide on how to apply for your efin &. Efin (electronic filing identification number). The following are the procedures or steps to get.

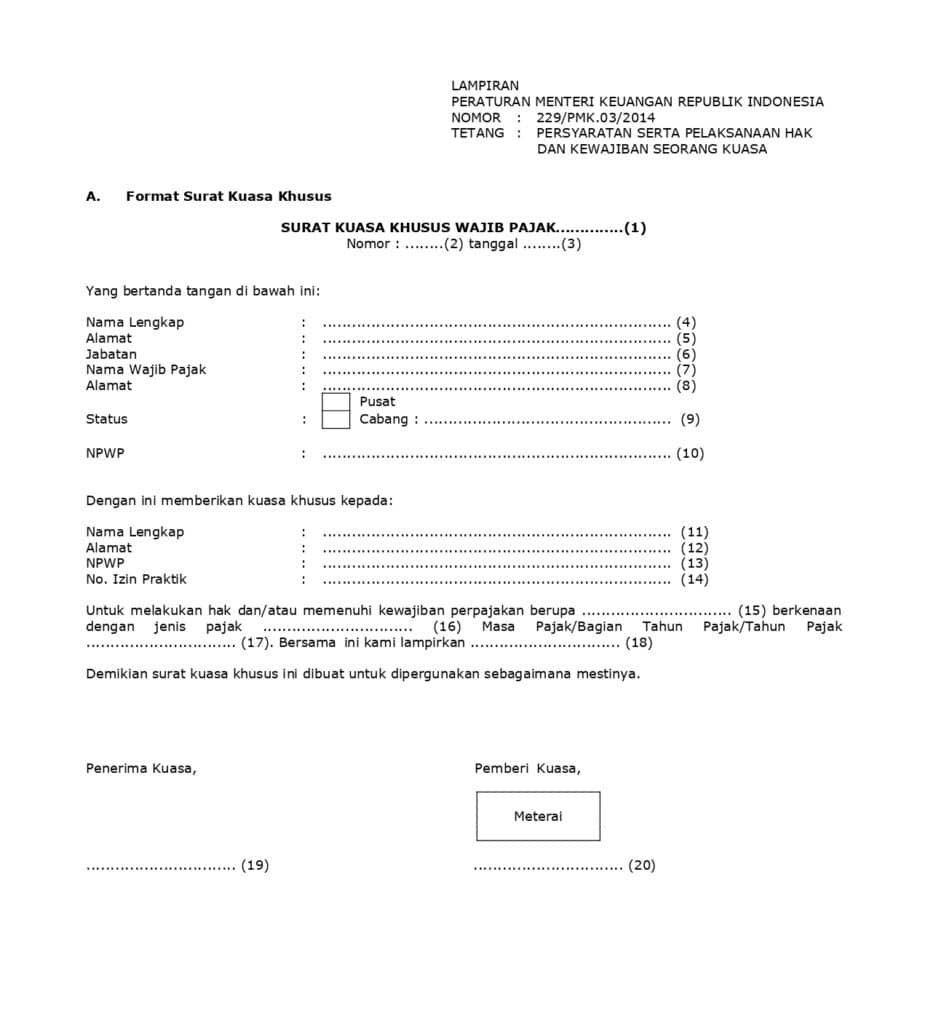

Requests for efin information should be handled through the appropriate tax software preparation provider’s portal after the. The application process for an efin involves several key steps. Klik link lampiran form permohonan efin pada laman tersebut.

This process may take up to 45 days. 17 views 2 months ago. Efin and ptin number (what it is and how to apply) isreal oyarinde.

Supply identification information for your firm. Principals who need to apply for an efin: 52k views 8 years ago desktop.

There must be an efin application for each office location; When do i need to apply for a new efin? Taxpayers who want to get an efin number can send submissions online via kpp email according to their respective domicile.

How do i apply for an efin number online?. How to apply for an efin. If you expand your business, an application is required for each location.

In 2012, the irs made efin as a requirement for tax prepar. Do you need to renew your efin. Effective in tax year 2011, federal legislation mandates that anyone filing more than 10 tax returns.