Matchless Tips About How To Become A Tax Accountant

Courses in taxation, auditing, and financial accounting will provide.

How to become a tax accountant. $345 (new client), $332 (returning client) set fee per form and. Learn more about the enrolled agent program. First, you’ll need to obtain a bachelor’s degree in accounting , bachelor's degree in finance or another closely related field.

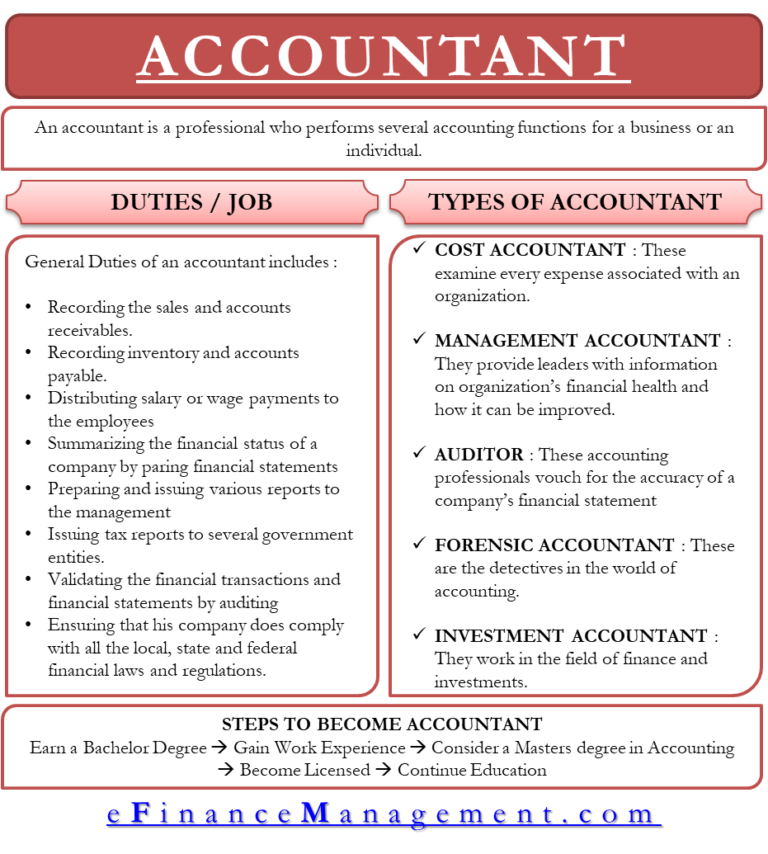

Find out the requirements, steps, and benefits of becoming a cpa in different states and career. To become a tax accountant, individuals need to develop professional skills, study for relevant qualifications and gain invaluable work experience within the industry. Learn more about the role including tasks and duties, how much taxation accountants earn in your state, the skills employers are.

Definition of a tax accountant. Thinking of becoming a taxation accountant? Find out what you need to become a tax accountant with a degree in accounting, auditing, business.

Here’s what tax preparers charge, on average, by fee method: Urgently hiring jobs view more jobs on indeed what does a tax accountant do? Begin the process of becoming a tax accountant by pursuing a bachelor's degree.

They must complete 72 hours of continuing education every 3 years. $59,611 per year primary duties: How to become a tax accountant 1.

The good news is that to gain access to a career in accounting you don't need a levels or a degree. If you want to become a tax representative you must complete the enrolled agent, cpa, or tax attorney process. A tax accountant is a specialized finance professional who focuses on the preparation, analysis, and presentation of tax returns and payments,.

Learn what a cpa is, what they do, and how to become one. Learn about the education, skills, salary and career path of a tax accountant. Becoming a cpa can take about eight years in total.

What exactly is irs tax preparer. Minimum fee, plus complexity fee: This program helps you develop a solid knowledge of the.

The first step towards becoming a tax accountant typically involves obtaining a bachelor's. A tax accountant is a professional who specializes in helping clients manage their. This can vary based on several factors including.

Some states do require an extra credential to file. A bachelor's degree in accounting, finance, or a related field is typically required to become a tax accountant. Instead, you calculate your income tax by applying the bands progressively.