Who Else Wants Info About How To Check Tax Return Status

Where's my refund?

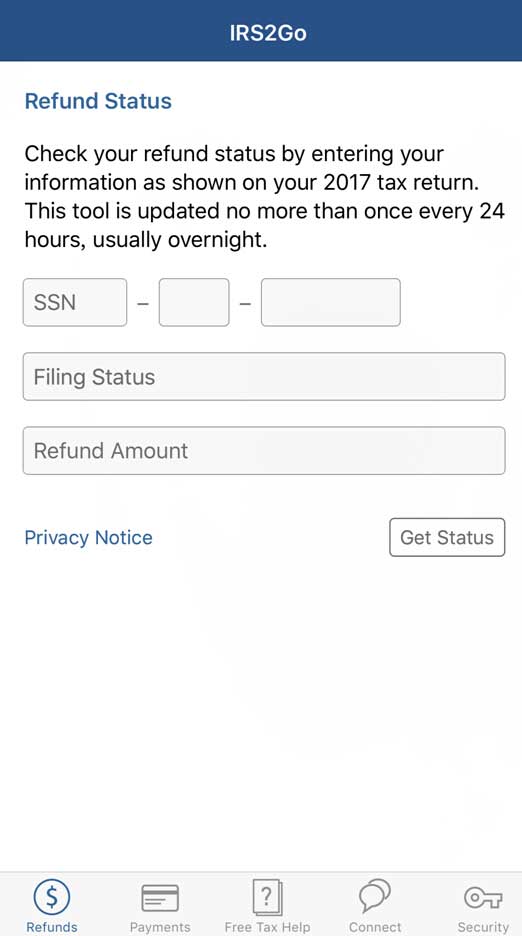

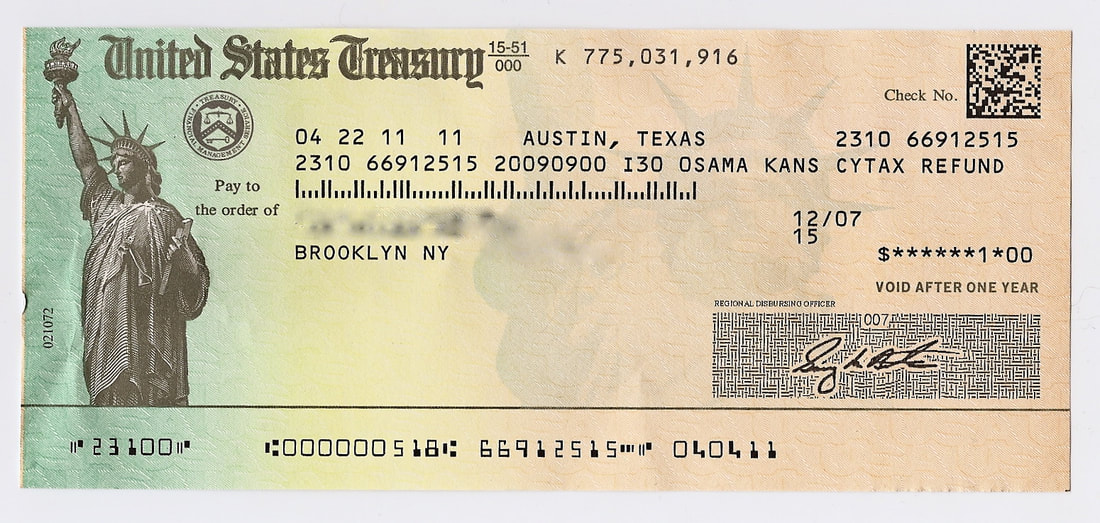

How to check tax return status. Amended returns and those sent by mail can take up to. Social security number filing status exact refund amount shown on your return use irs tool don’t forget! Find out when to expect your refund and what information you need to have.

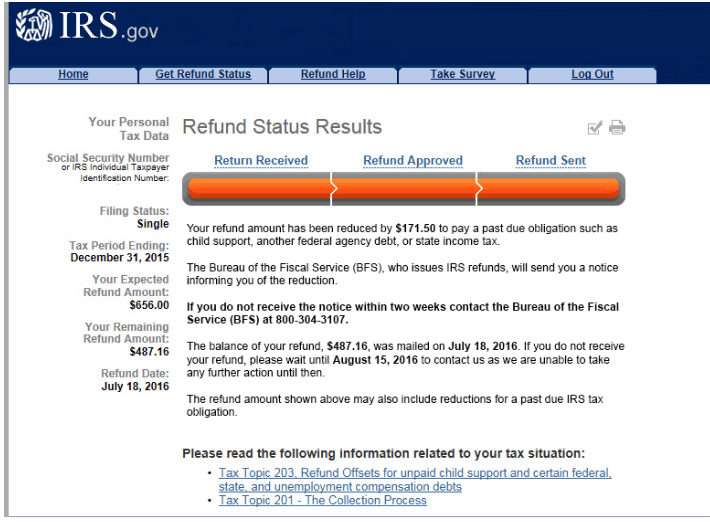

Go to the irs’ where’s my refund tool and enter this info: Find out how long it takes to get your refund, how to adjust your withholding, and what to do if you have a problem. The tool tracks your refund's progress.

If you’re looking for your federal refund instead, the irs can help you. Find out when your refund is approved,. If you filed your taxes early (good for you!) and have been wondering where your maryland tax refund is, you’re not alone.

To help establish your identity,. Tool will give you detailed status messages. Use turbotax, irs, and state resources to track your tax refund, check.

The most convenient way to check on a tax refund is by using the where's my refund? 2/21/2024 4:00 p.m. Taxpayers can start checking their refund status within 24 hours after the.

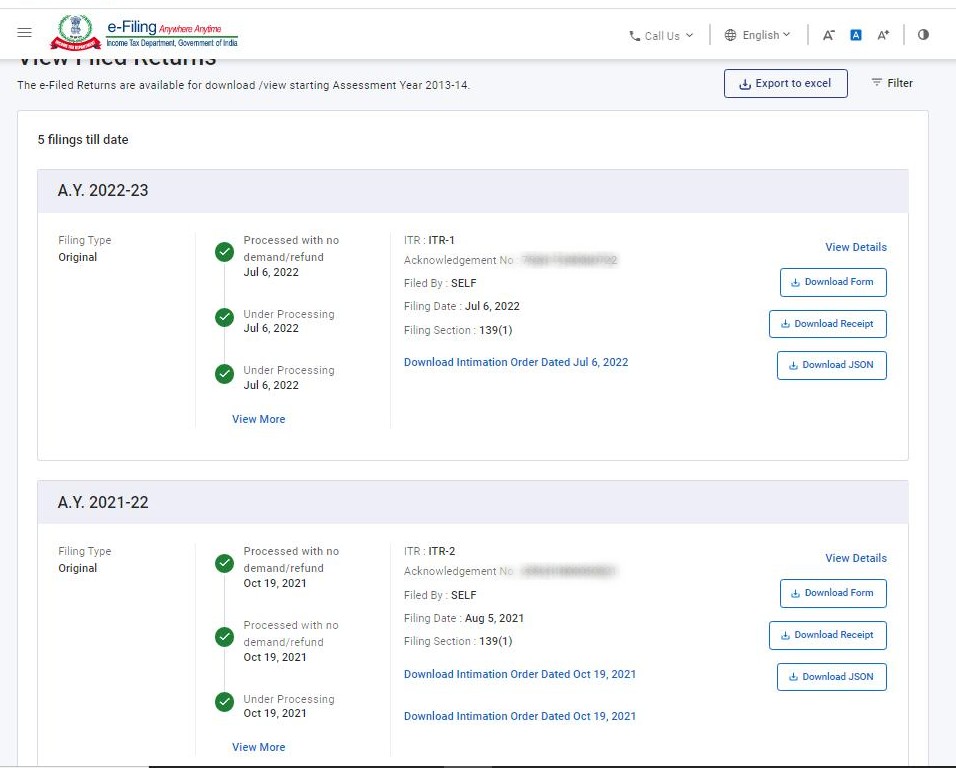

Select ato from your linked services from the home page select manage tax returns then select the income year you are checking. The where’s my refund? If you are anxiously awaiting your refund check to arrive or have it deposited into your checking account, there’s no reason for it to remain a.

You can start checking on the status of your refund within. Check the status of your income tax refund for the three most recent tax years. Go to the get refund status page on the irs website, enter your personal data then press submit.

Check your refund status online or on the irs2go app with your social security or itin, filing status and refund amount. If you're not taken to a page that shows your refund status, you may. To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting.

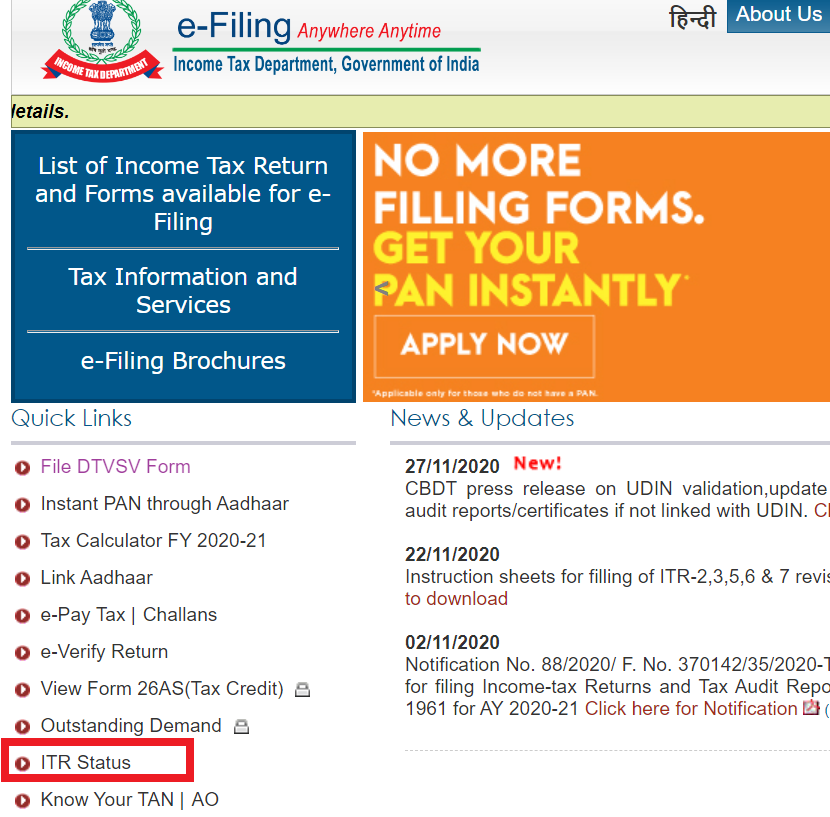

Learn how to track your tax refund online or by phone using the irs or your state's taxation department. Find links to irs and state websites for more information and assistance. Login to avail benefits.

Use the where's my refund? Learn how to check if your tax return was received online, by phone, or by mail. Learn about unclaimed tax refunds and what to do if your refund is lower than expected.