Exemplary Tips About How To Claim Inheritance

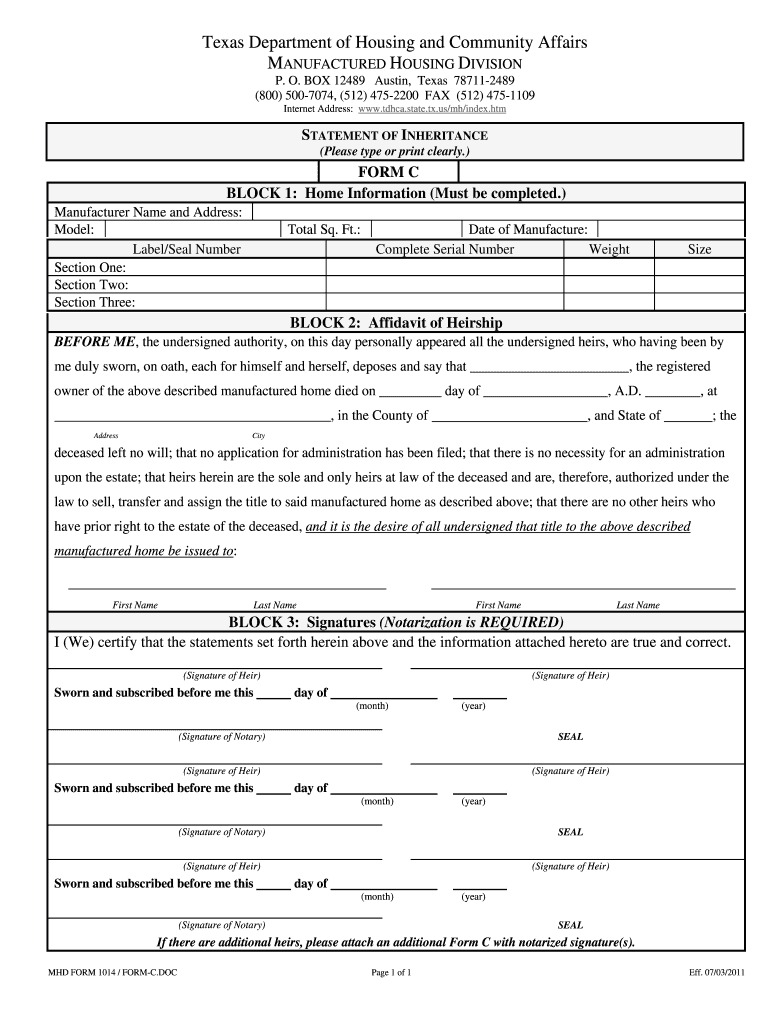

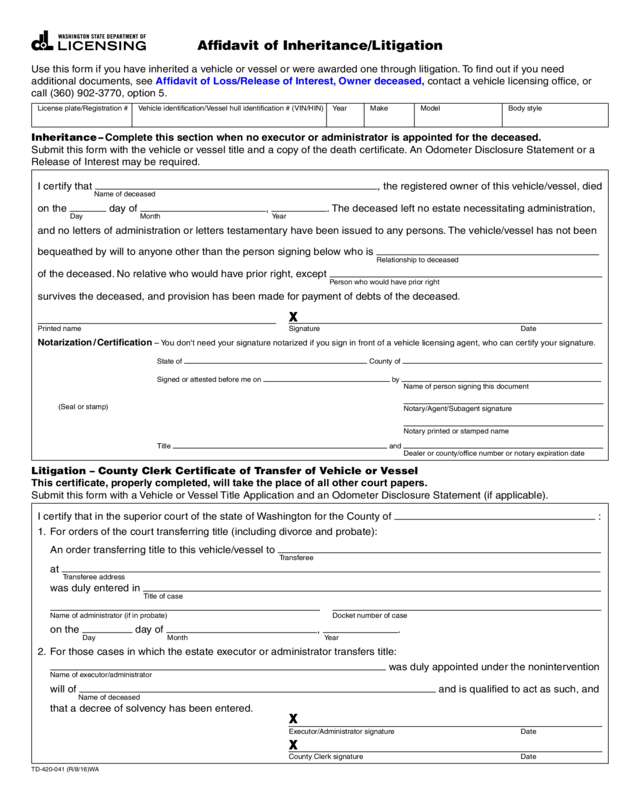

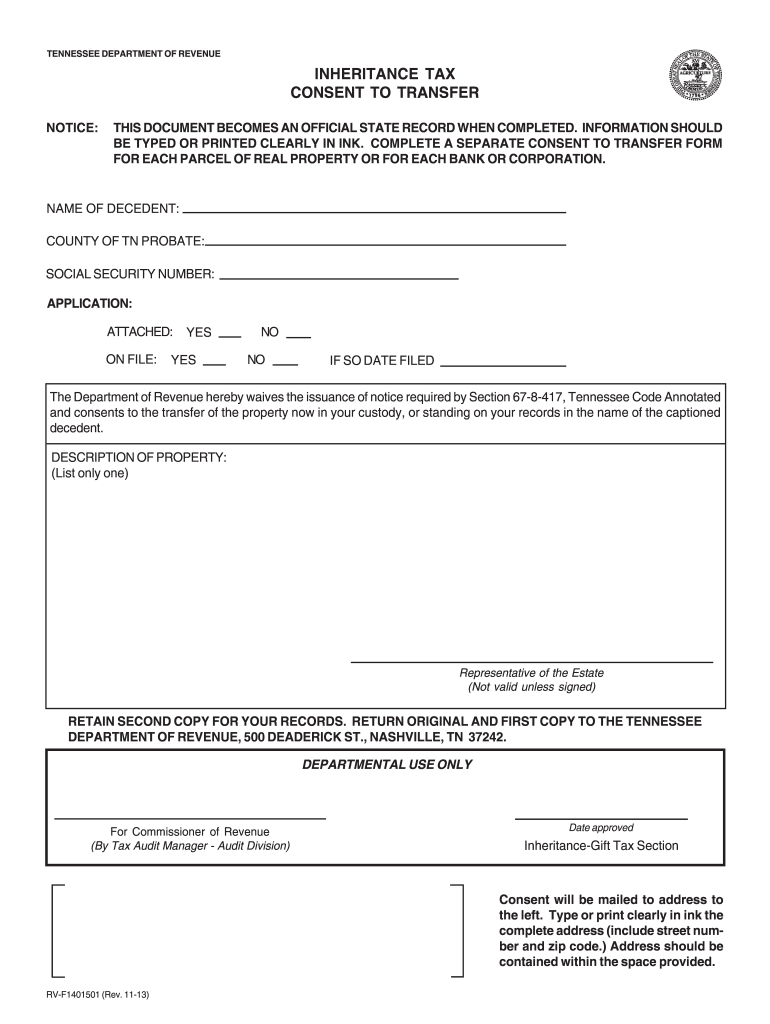

Many courts provide a form which you must file with the court as notice of your claim to an inheritance.

How to claim inheritance. With inheritance funding, you can receive a portion of your. The bottom line of all this was that the trustee's objection to. Steps to follow when claiming assets.

Fill out the claim notice form as. This guidance is for information only, is not intended to be legal advice or to cover every situation that may arise when claiming an estate. To claim an inheritance for yourself, there are three basic options:

Some options bypass probate, a court proceeding to divide assets. Therefore, it is essential to be prepared by understanding the basics of. The first step in making a claim is to seek legal advice as soon as possible.

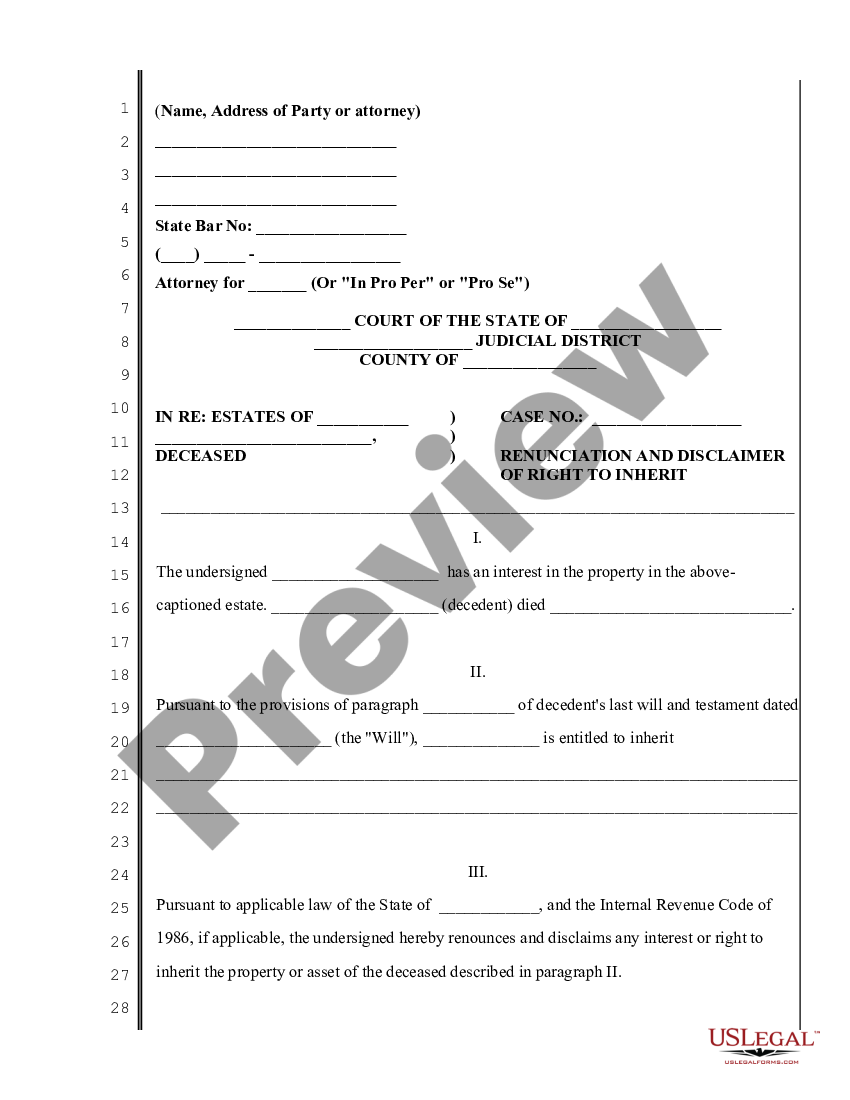

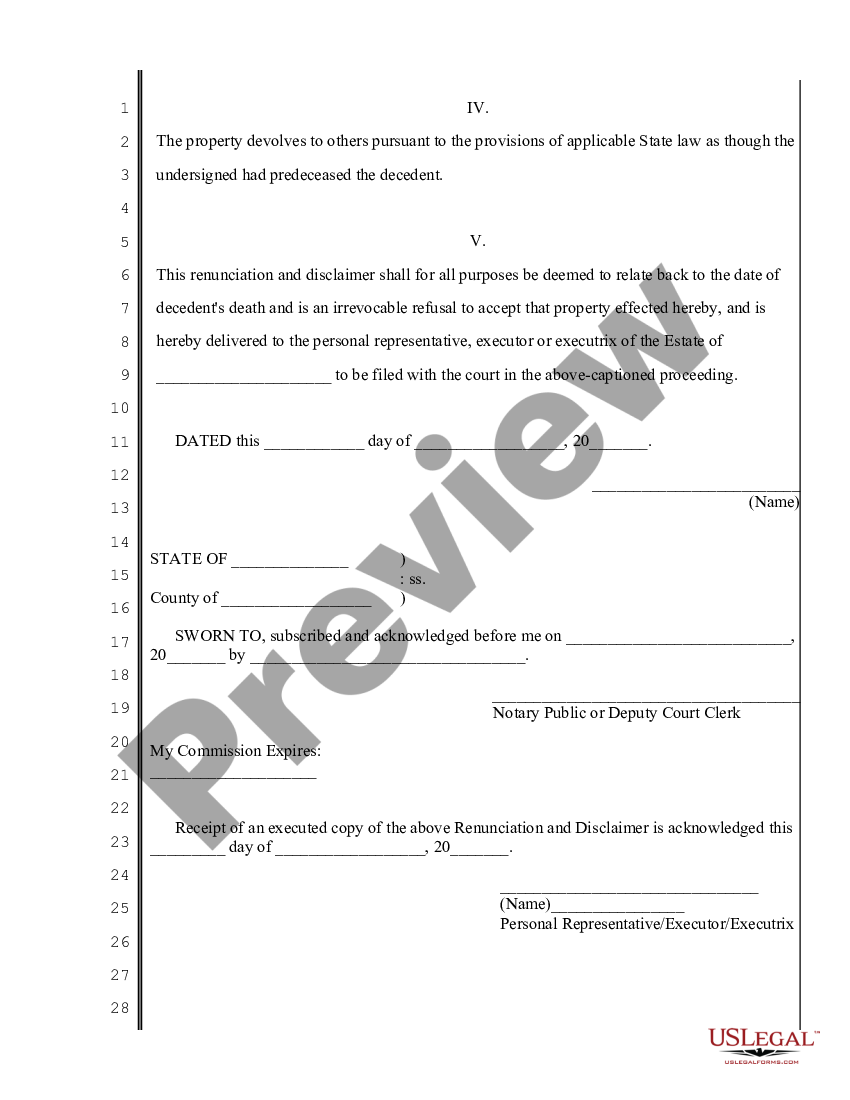

In a nutshell, it means you’re refusing any assets that you stand to inherit under the terms. Some very close relatives—meaning a surviving spouse and sometimes children or grandchildren—have. 4 ways to receive inheritance there are several different ways to pass on an estate.

The only disadvantage is that you are required to take a minimum pension each year which increases as you get older. Your closest relatives may have a right to claim part of your estate. The details are different depending on the specifics of.

And give an indication of how soon you will receive. Rolling over, cashing out, or leaving the money where it is. To do this, simply follow your state’s.

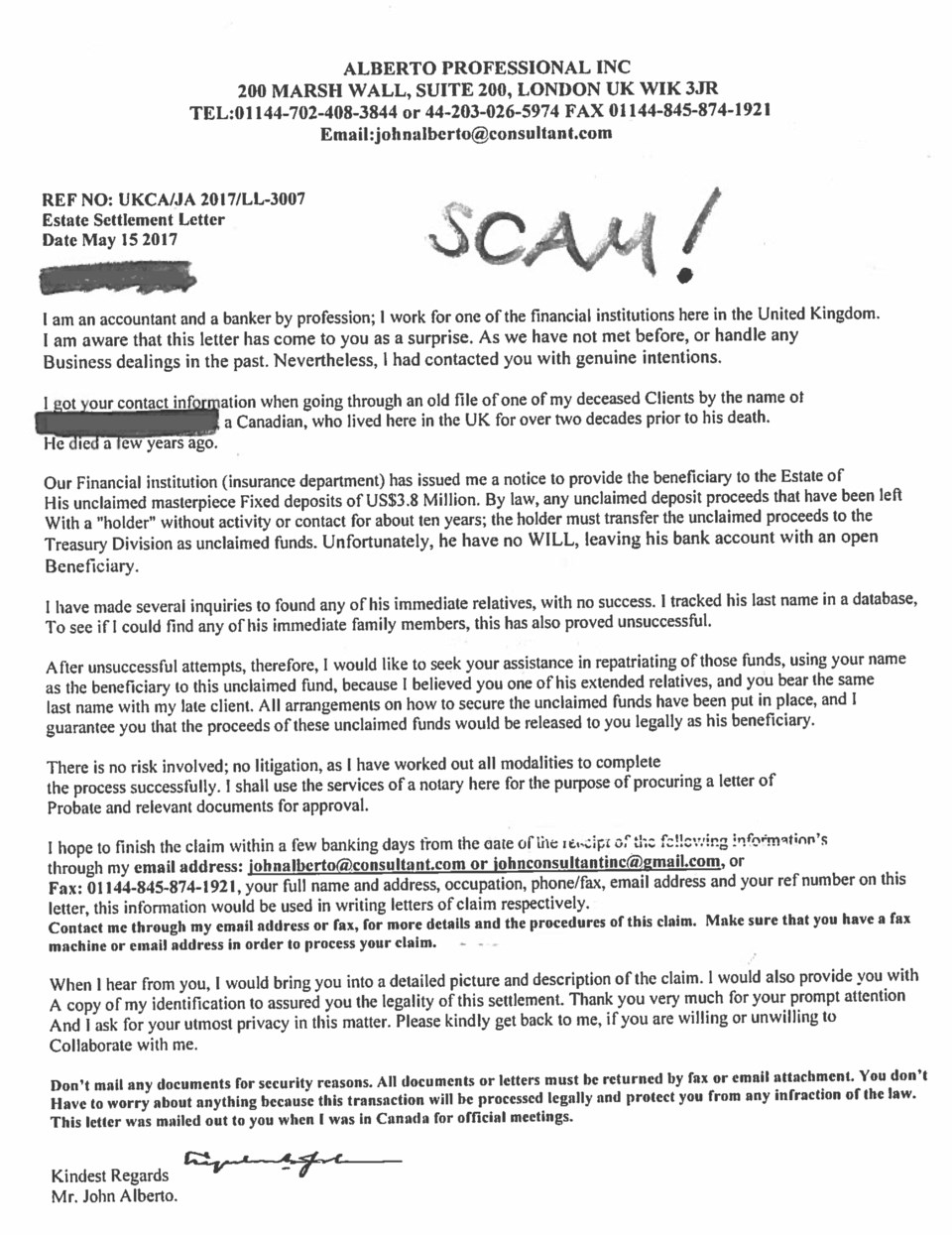

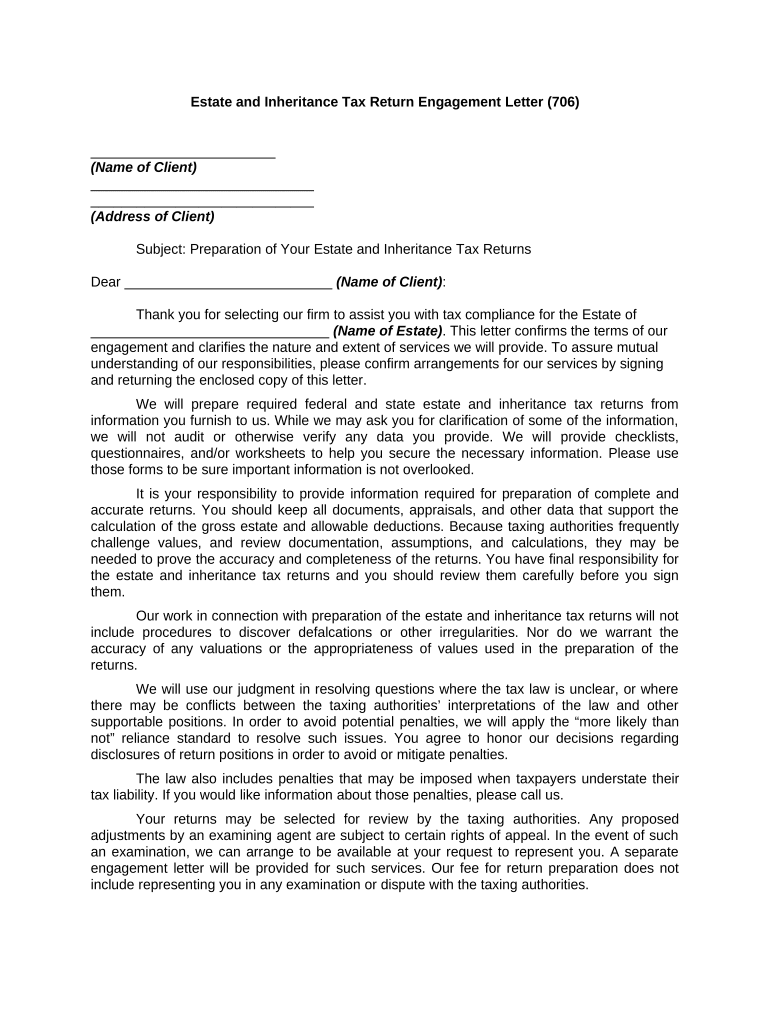

The inheritance process the legalities concerning inheriting money or property can be complex. Depending on individual circumstances, the next stage would be to collate evidence and. The nine community property states are arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin.

Home / learn / receiving an inheritance in canada receiving an inheritance in canada sandra macgregor contributing writer 3 minute read fact checked wills in canada, an. Ask the deputy clerk for a claim notice form. Confirm that you are a beneficiary of the estate;

First, it’s important to understand what disclaiming an inheritance means. The tool is designed for. When a person dies, their estate will be distributed in accordance with their will, or if they died without a valid will the rules of intestacy, so.

Thus, the court found that only $7,000 was exempt and the remaining $73,000 could not be exempted. You can be named in the last will and testament of a person who died. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable.