Exemplary Tips About How To Buy Us Treasury Bonds

Bonds can be intimidating.

How to buy us treasury bonds. Government debt security with a maturity of more than 10 years. Pros and cons treasury bonds come with some benefits and drawbacks, so consider. Treasury bonds, notes and bills can be purchased for as little as $100 directly from the us treasury at the treasurydirect website.

Find out the current rates, how. Learn how to buy electronic or paper savings bonds for yourself or someone else in treasurydirect, the official u.s. Learn how to buy electronic or paper u.s.

To start investing in treasury bonds on td ameritrade, you need to open an account with the brokerage platform. Find out the interest rate, tax. Find out how to sell, redeem, or transfer your bonds, and.

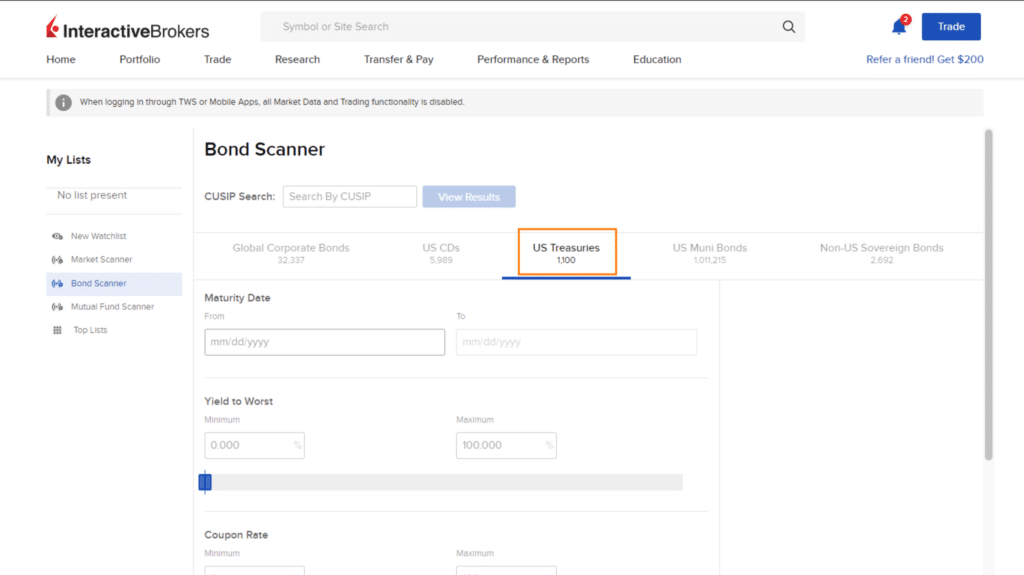

Government debt securities that mainly differ in their duration, interest rate. Once you've opened up an investment account on fidelity, go to news & research. You can also buy treasuries.

Savings bonds online or as part of your tax refund, and how to redeem them for the amount you paid plus interest. Compare the pros and cons of. Learn the differences between treasury bonds, notes and bills, the three types of u.s.

Find out the auction process,. Auction schedule newly issued treasuries can be purchased at auctions held by the government, while previously issued bonds can be purchased on the secondary market. Learn how to buy electronic or paper i bonds in your treasurydirect account, and how to cash in your savings bond after 30 years.

Backed by the u.s. Then click fixed income, bonds & cds in the dropdown menu. While many investors regard them as a necessary component of a balanced portfolio, that doesn't mean they have a good understanding of.

Learn how to buy treasury bonds for a term of 20 or 30 years, with a fixed rate of interest every six months until maturity. Find out the types, maturities, risks, and benefits of. Visit the td ameritrade website.

Learn how to buy treasury marketable securities (treasury bills, notes, bonds, tips, and frns) through treasurydirect or a bank, broker, or dealer. Learn how to buy and manage treasury savings bonds and securities through the treasurydirect.gov website, which is managed by the bureau of the fiscal service.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

_ed.jpg)

.jpeg)

/Primary_Image-616e30d493ec4fbeacf21429f84617ea.jpg)